August 7, 2016

Published by admin at August 7, 2016

Categories

Have you ever played a maze when you were a kid? In Hong Kong Disneyland, there’s a maze located at the garden outside the hotel which has a shape of a Mickey Mouse head if seen from a distance above. The height of the bushes is designed so that little children’s sight would be blocked when they go inside the maze. For a small child, this maze is a daunting yet at the same time fun experience. They need to find a way out through the maze and there are many dead ends inside. Even for adults who already know the exit direction, they may still take […]

August 7, 2016

Published by admin at August 7, 2016

Categories

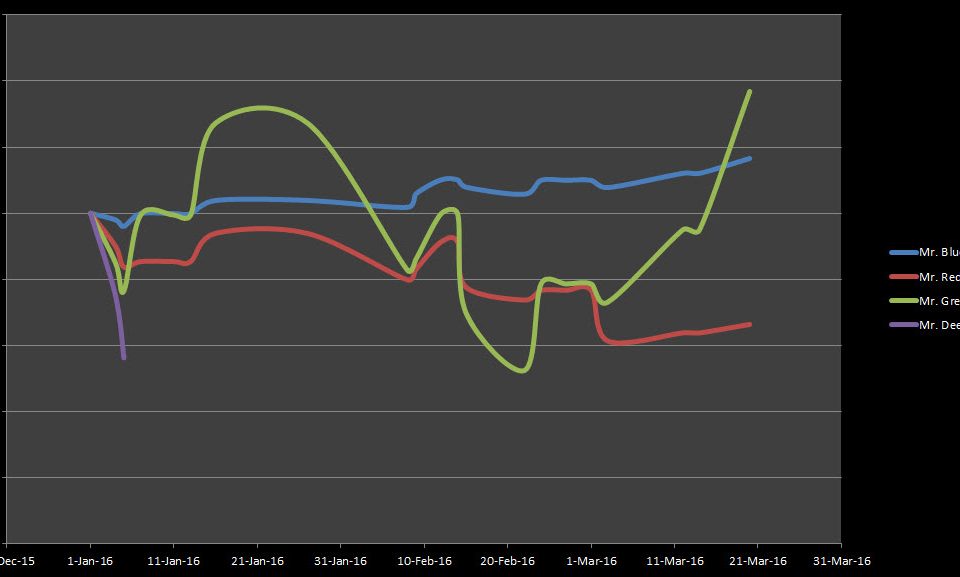

This is a non-technical blog that contains some facts and precious truths. These 5 tips could forever change your trading perspective in a better way. Let’s take a look at them: 1. Think about the risks. Before entering the trade, you should be aware that any trade could end up being negative one, regardless of how strong your setup is. So, don’t over-leverage your position size and risk only 1-2% of your account per trade. In that way you’ll be able to make rational decisions and trade without emotions. There’s a great saying:”Winners always think about the risks while losers think only […]

August 7, 2016

Published by admin at August 7, 2016

Categories

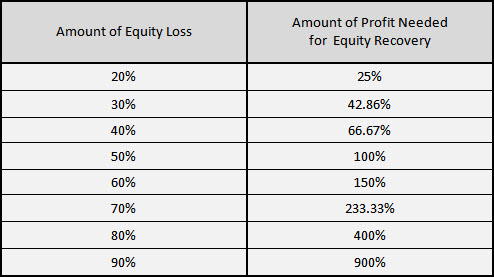

As we have mentioned, every trader besides ability to forecast the market well, should also have good psychology and good money management in order to be successful. One of the most important things is to know how to manage the risks well and keep them as low as possible. As the rule says, you shouldn’t risk more than 2% of your account for each trade you make. If you find a 2% rule overrated and you think being consistent to it is irrelevant, keep reading this blog and you’re going to find out how bad money management could affect your […]

August 7, 2016

Published by admin at August 7, 2016

Categories

There are 3 major key factors in Trading that every professional trader should have: 1. Ability to forecast the market 2. Good Money management 3. Good Psychology. It’s crucial for all three factors to be included in order to succeed. If just one of these 3 mentioned factors is missing, the trader will fail. In this blog we’re going to get through some important tips on how to improve Money Management strategy. Before we continue, here’s a short reminder: check out New EWF blogs and Free Elliott Wave charts. 2% rule This one is the key money management tip for […]

August 7, 2016

Published by admin at August 7, 2016

Categories

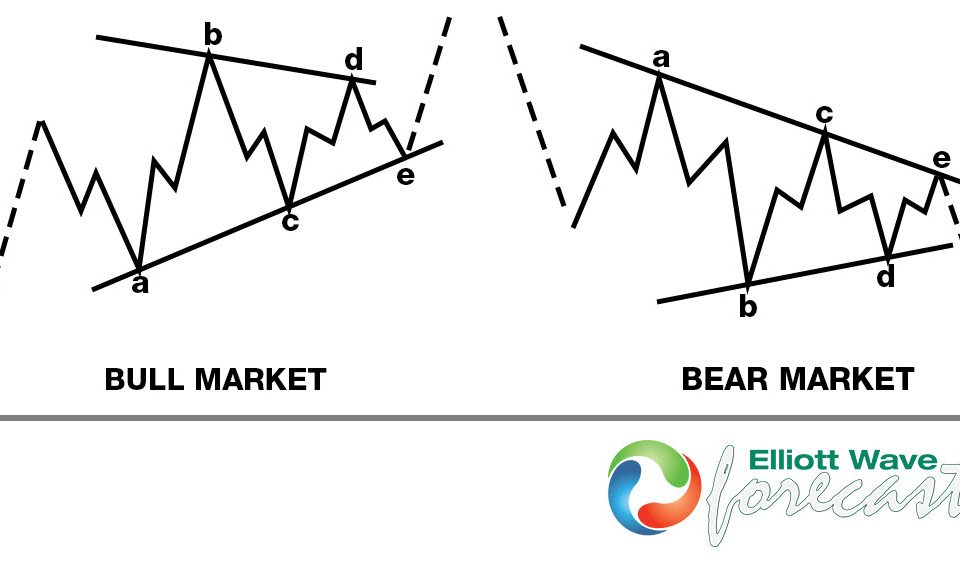

Triangle is an Elliott wave pattern seen during sideways market consolidations, it is composed of 5 corrective sequences. Triangle presents a balance of forces between buyers and sellers, causing a sideways movement that is usually associated with decreasing volume and volatility. This pattern subdivide into 3-3-3-3-3 structures labeled as A,B,C,D,E. Triangle is continuation pattern which breaks in direction of the preceding move. It could occur in wave 4 in an impulsive structure, wave B in a zig-zag and wave X connector in double and triple threes Elliott wave structures. It could also occur in wave Y of a WXY structure in which […]

August 7, 2016

Published by admin at August 7, 2016

Categories

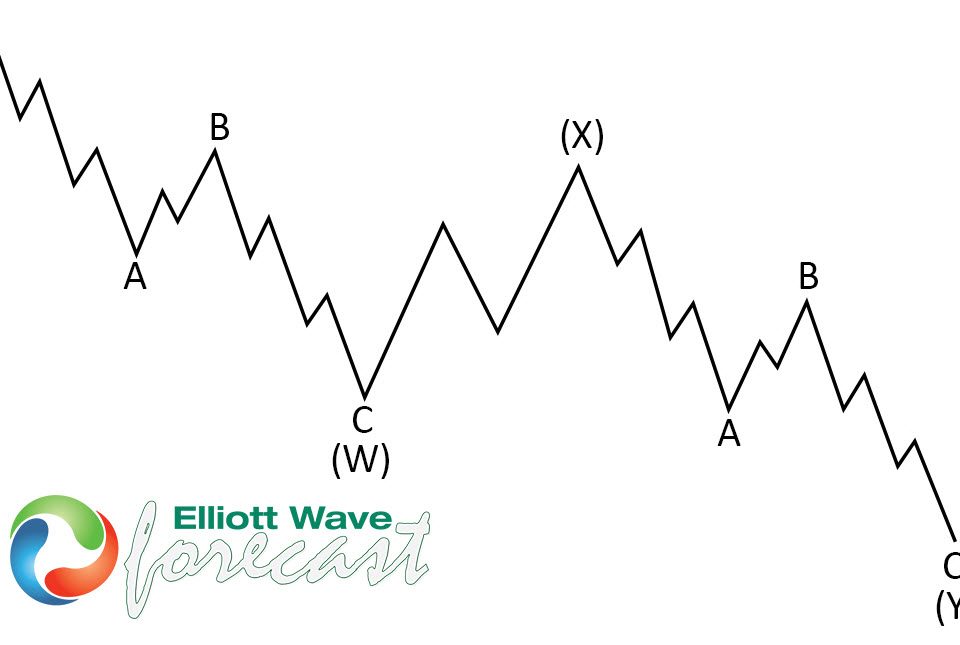

Double three is the most important patern in New Elliott Wave theory and probably the most common pattern in the market these days, also known as 7 swing structure. It’s a very reliable pattern which is giving us good trading entries with clearly defined invalidation levels and target areas. The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree. Now, let’s […]