In this article blog you will learn how to deal with Elliott Wave Extensions which occur within impulsive structures. One of the basic rules in Elliott Wave theory says that in 5 wave structure, wave 3 can’t be the shortest one. However, this does not necessary means that wave 3 should always be extended. Although the extension withing wave 3 is the most comment, extensions could also happen within wave 5 or wave 1.

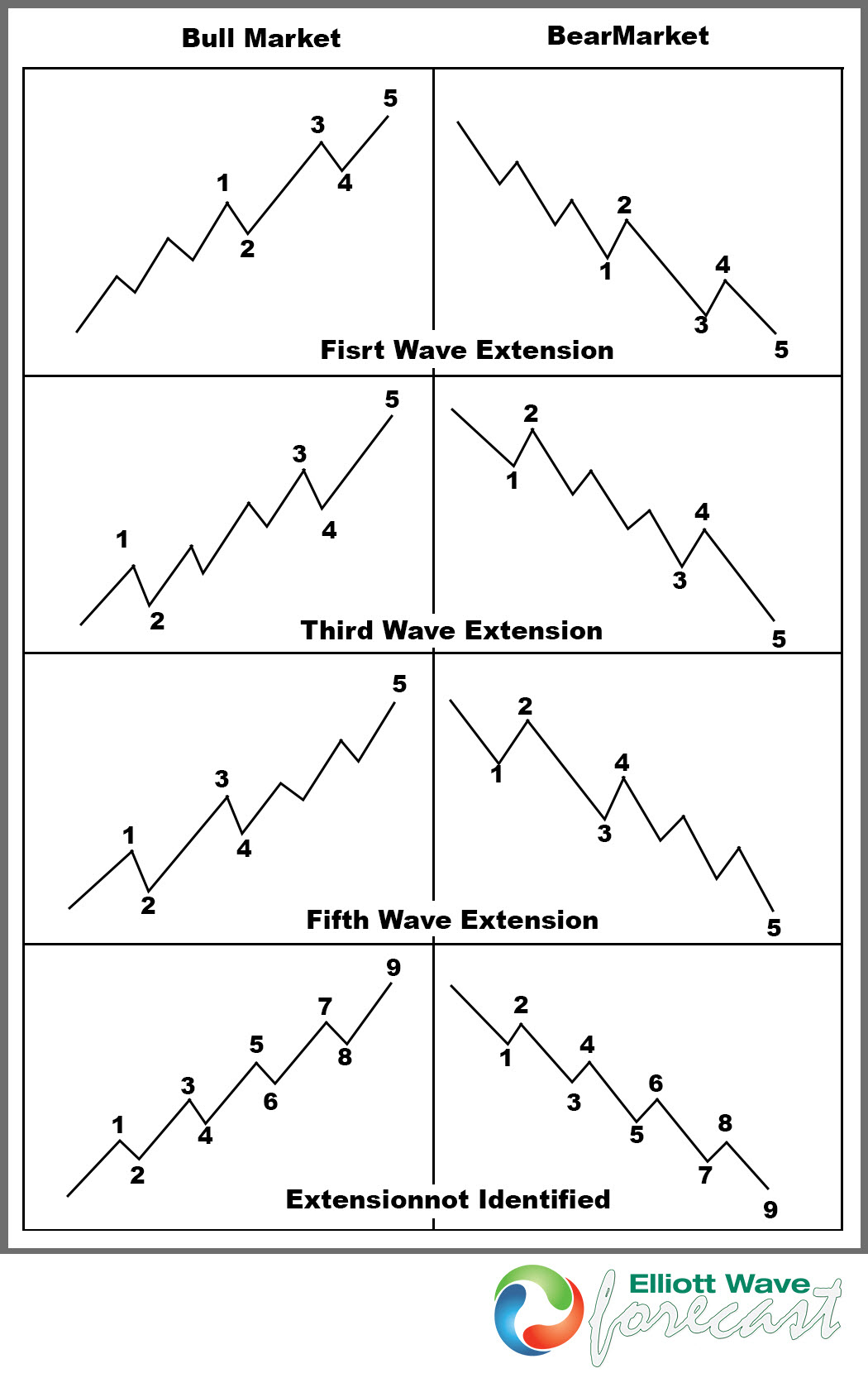

In the picture below, you can see what Elliott wave extensions look like in all three cases : whithin wave 1, wave 3, and wave 5:

Statistic says that in 90% of the time extension occurs in wave 3 which makes it the most powerful wave. In that case wave 3 must give us at least 1.618 fib extension of wave 1 and could go up to 2.618 fib ext or more… In other cases, it’s more likely that extension would appear in wave 5 than in wave 1.

Elliott Wave Extensions: Important rules to follow:

– If wave 5 is extended -wave 3 needs to be longer than wave 1, otherwise Elliott Wave count is wrong.

– If wave 1 is extended – wave 5 must be shorter than wave 3, otherwise Elliott Wave count is wrong.

– If wave 3 is extended- wave 5 target could be got in 2 ways. It could be eather equal in length to the wave 1 or it’s 61.8% fibonacci extension of the length wave 1+wave 3 related to the wave 4.

– Impulsive waves with at least 1 wave extended should at least contain 9 swings and would increase to 13 or 17 swings if there are more extensions within.

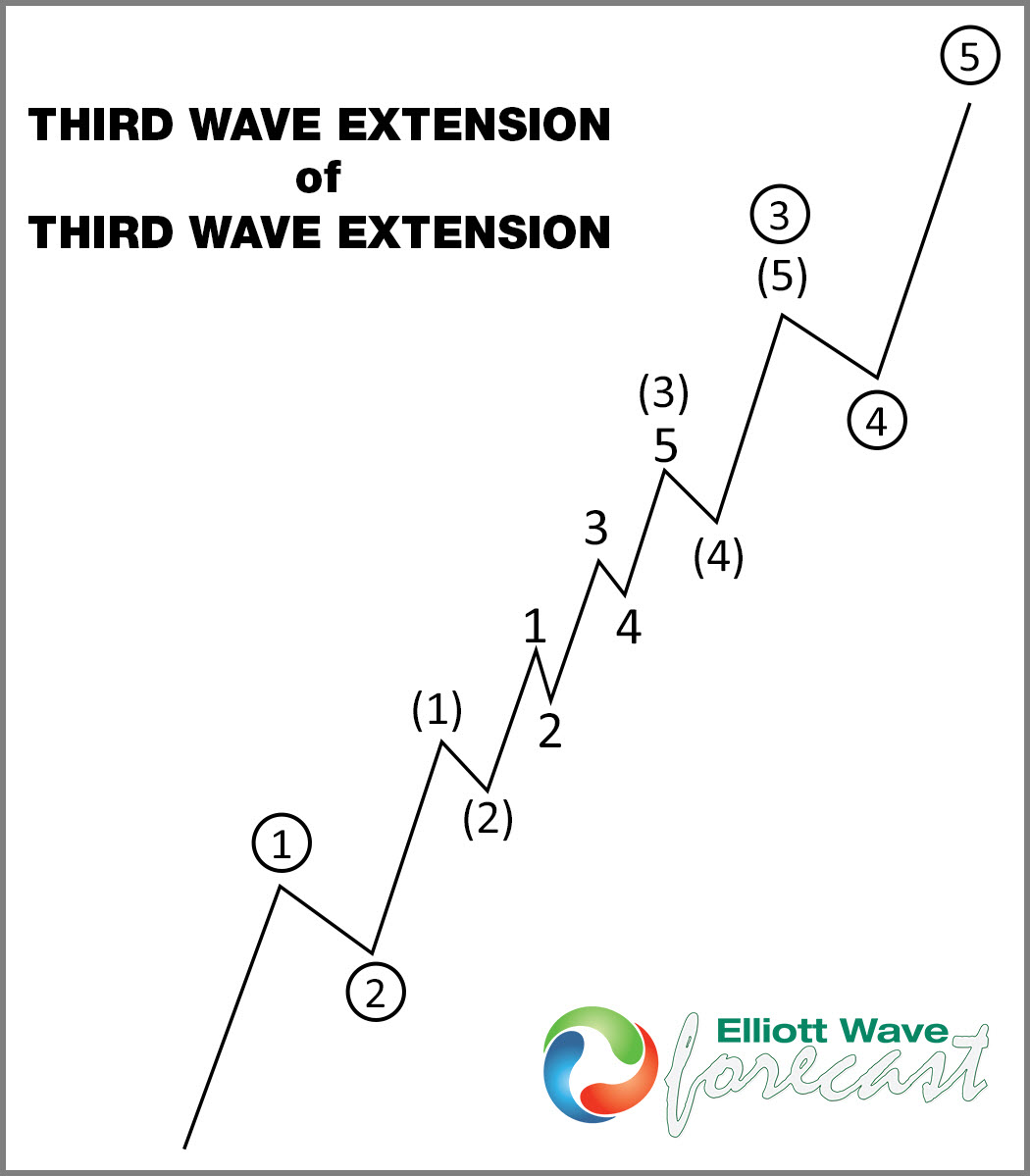

Next picture shows the most common scenario which occurs in impulsive structures, third wave extension of third wave , also known as 13 swings structure.

Elliott Wave Extensions Final Summary.

Proper Elliott Wave counting is crucial in order to be successful trader. If you want to learn more on how to implement Elliott Wave Theory in your trading, fell free to join us. You will get access to Professional Elliott Wave analysis in 4 different time frames, 2 live webinars by our expert analysts every day, 24 hour chat room support, market overview, daily and weekly technical videos and much more…

If you are not member yet or Elliott Wave Subscribers, just sign up here to get your Free 14 days Premium Plus Trial. Welcome to Elliott Wave Forecast !