Have you ever played a maze when you were a kid? In Hong Kong Disneyland, there’s a maze located at the garden outside the hotel which has a shape of a Mickey Mouse head if seen from a distance above. The height of the bushes is designed so that little children’s sight would be blocked when they go inside the maze. For a small child, this maze is a daunting yet at the same time fun experience. They need to find a way out through the maze and there are many dead ends inside. Even for adults who already know the exit direction, they may still take the wrong turns along the way. This is clearly a simple maze for an adult’s standard, although it can be quite challenging for a 5 year old kid.

Now imagine a complex maze that not only has many dead ends, deadly traps, and wrong turns, but the maze is actually alive and keeps changing the formation so you can never figure it out completely; a maze similar to the one depicted in the movie and book called “The Maze Runner.” This is the sort of maze that more closely resembles “the Market.” The Market, whether it be forex, stock, or commodity, is a perpetually changing maze. It’s able to surprise traders many times and when traders think they have figured it out, the market changes the formation and humbles them. Just like the movie and book “The Maze Runner”, many people got hurt playing the maze and some could never recover. So how can traders navigate this deadly and complex maze called the Market?

First, it’s very important to have a map and a compass on hand, so you don’t get lost inside the maze. The map and the compass is what we call Elliottwave charts. The map may not be perfect in all the little details; it may miss some turns here and there, and it may not have all the labels for dangerous areas and deadly traps. This is especially true when we are talking about charts in the lower time frame such as 1 hour Elliottwave charts. Despite the imperfection, without the maps, traders will certainly get lost inside the maze.

Second, it’s important to make sure you have enough food and water to sustain you inside the maze until you reach the exit. Knowing and expecting that you may make wrong turns, reach dead ends, and spend some time inside the maze, how would you manage your supply wisely? Traders who risk a lot in a single trade is akin to someone who consumes all the food and water before they reach the maze exit. Soon, all their capital is gone when they take the wrong turns, and they have nothing left to keep playing in the maze. Traders with open mind who understand the short term shifting nature of the maze should control their risk and change the course when they reach a dead end. This is the process of adjustment in Elliottwave, and there should not be any ego involved. When traders don’t adjust, the Market is going to take away their money.

The mistake of a beginner trader is to focus too much only on the short term time frame chart and expect it to be perfect. They also do not manage their supply properly, and thus have poor risk management. They get disillusioned thinking that short term map only has 1 perfect path that is always right. They don’t understand the idea that maze formation (Elliottwave structure) can change especially in the short term as the Market is like a living organism that perpetually shifts, but the overall direction in higher time frame still can remain the same and reliable.

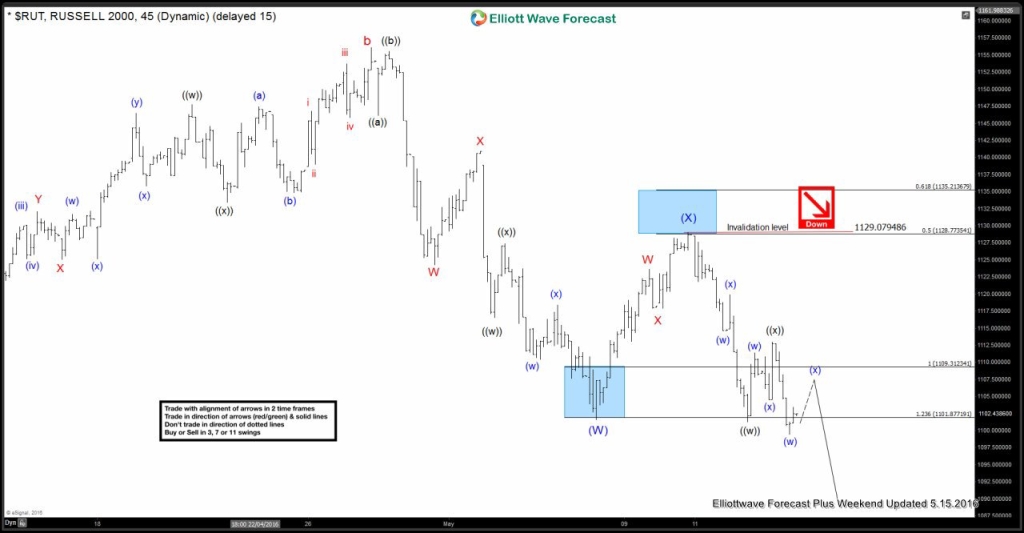

An example of a short term shift (adjustment) can be seen in 1 hour chart of Russell 2000 below:

1 hour weekend chart of Russell 2000 on 5/15 above is showing that Index should continue lower after a bounce in wave (x). As the Index shows a sequence of lower low, wave (x) bounce is expected to fail below wave ((x)) at 1112.96 for continuation lower. In the next two days, the Index instead rallied and broke above wave ((x)) or above 1112.96. Let’s take a look at 1 hour chart of Russell 2000 on 5/17 below:

As the 5/17 chart above shows, Russell broke above 1112.96 and the short term structure shifts to a flat. The main bias however is still to the downside and the invalidation level at 1129.08 does not change. The Index then proceeded to make a new low again as expected, as shown in the latest Asia chart 5/18 below

In this example, we see a short term adjustment in Russell 2000 structure while the main bias to the downside doesn’t change. The next short term move in Russell may shift again, so it’s important to understand the third point below.

Finally, it’s important to always keep the location of the final destination in mind and keeps moving towards that direction, even though you may need to change short term route periodically. The usefulness of the map increases when traders use it to provide the overall direction. Elliottwave Charts in the weekly and daily time frame provide this overall direction and bias, while the lower time frames in 1 hour and 4 hour attempt to provide more details.

When the map says the exit is located at the South of the maze, then you should try to keep moving to the South until you reach the target. You should not try to move to the East, West, or North because there could be deadly traps in there. Taking this principle to trading, if the daily and weekly Elliottwave charts show the location of the exit is lower, then traders want to keep trading towards the main direction lower (trend trading) by selling rallies instead of doing any counter-trend trade. Using the Russell 2000 example above, you should not try to buy the Index as the higher time frame is showing the bias to the downside.

Concluding Words:

Before you click the next buy/sell order, remember the lesson from the Maze and ask yourself the following questions:

1) Do you know the exit location of the maze and do you understand that the maze is perpetually shifting, more so than ever in the lower level (lower time frame)?

2) Do you manage your supply well and have proper risk management so you can keep playing in the maze?

3) Do you keep moving towards the exit location or do you move to every direction?

For further information on how to find levels to trade forex pairs, indices, and commodities using Elliottwave, take our FREE 14 Day Trial. We provide Elliott Wave chart in 4 different time frames, up to 4 times a day update in 1 hour chart, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more! With our expert team at your side to provide you with all the timely and accurate analysis, you will never be left in the dark and you can concentrate more on the actual trading and making profits.