Criteria of Impulsive Elliott Wave structure

August 7, 2016

Elliott Wave Triangle Structure

August 7, 2016Elliott wave pattern : Double Three (WXY) Structure

Double three is the most important patern in New Elliott Wave theory and probably the most common pattern in the market these days, also known as 7 swing structure.

It’s a very reliable pattern which is giving us good trading entries with clearly defined invalidation levels and target areas.

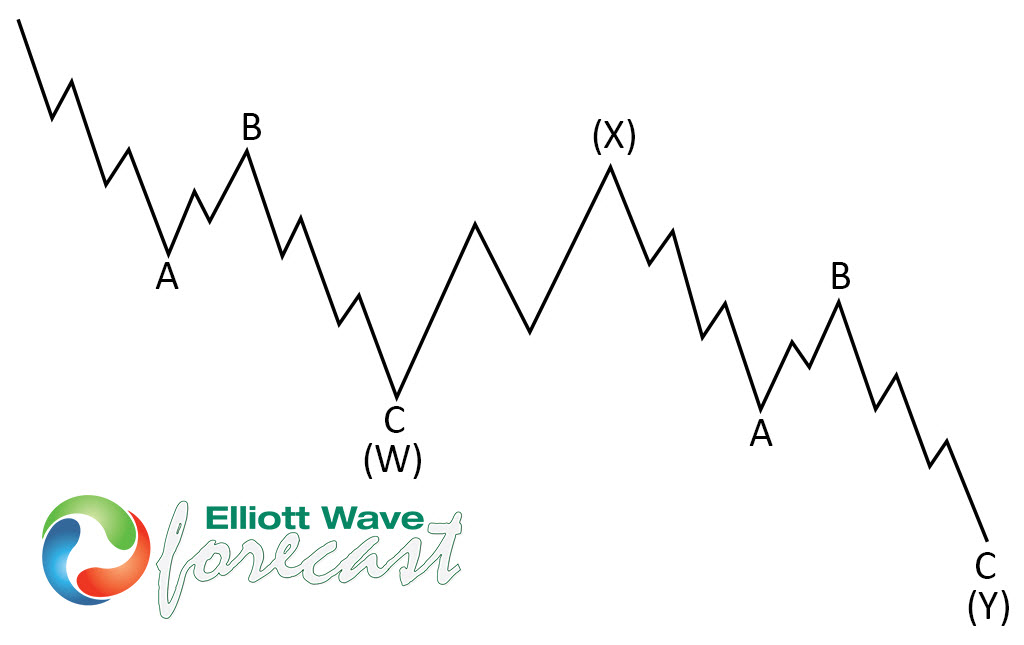

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree.

Now, let’s take a look at some real example

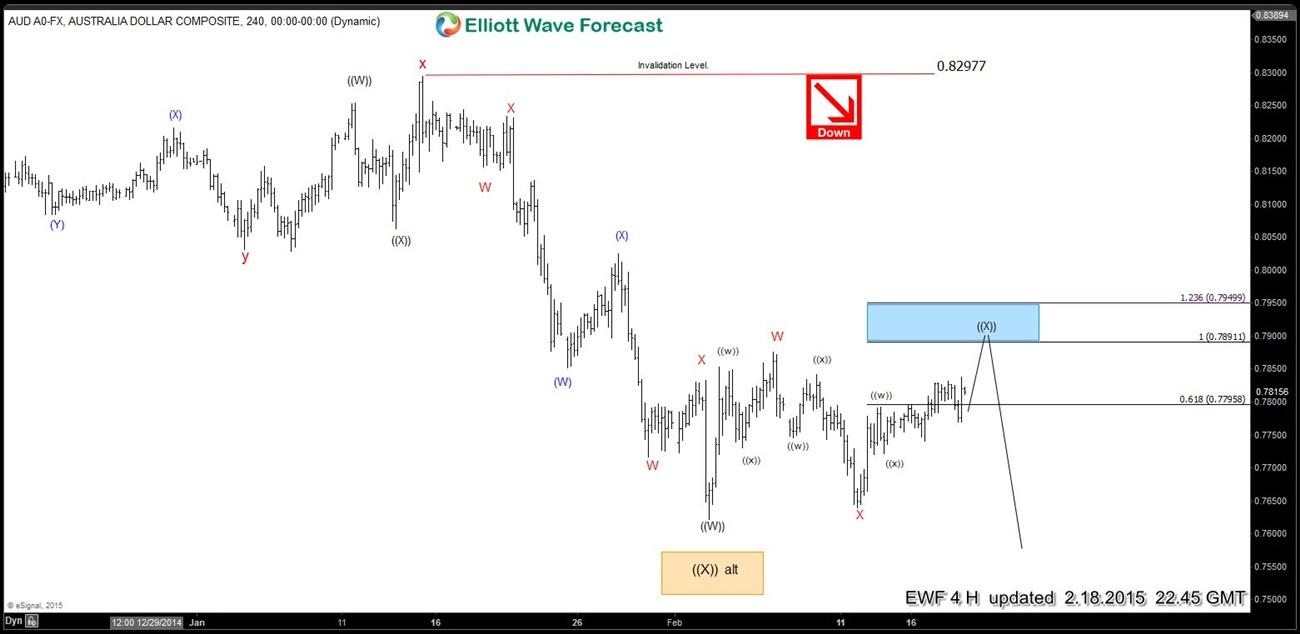

$AUDUSD h4 update 2.18.2015. We assume that pair is doing Double Three patern in wave ((x)) –correcting the cycle from 0.82977. As you can see wave W (red) has 3 swings ((w)), ((x)), ((y)).

X(red) is deep pull back which also has 3 wave structure, and current view suggests we still need another push higher toward marked area to complete Y(red) as 3 wave structure.

At that time our clients were prepared to sell the pair at 0.78911-0.79499 area.

$AUDUSD h4 update 3.10.2015. Wave ((X)) recovery has ended as Double Three Elliott Wave Pattern at proposed area and we got expected decline.

If you would like to learn more about Elliott Wave patterns, sequence of swings and how to trade them and get access to EWF charts in real time, feel free to join us. Now you have an opportunity to sign up for 14 Days Trial and get a Full access of Premium Plus Plan for 2 weeks.

We provide Elliott Wave Analysis of 41 instruments in 4 different time frames, 2 live webinars by our expert analysts every day, 24 hour chat room support, market overview, daily and weekly technical videos and much more.

If you are not member yet, just sign up here to get your 14 days Premium Plus Trial.