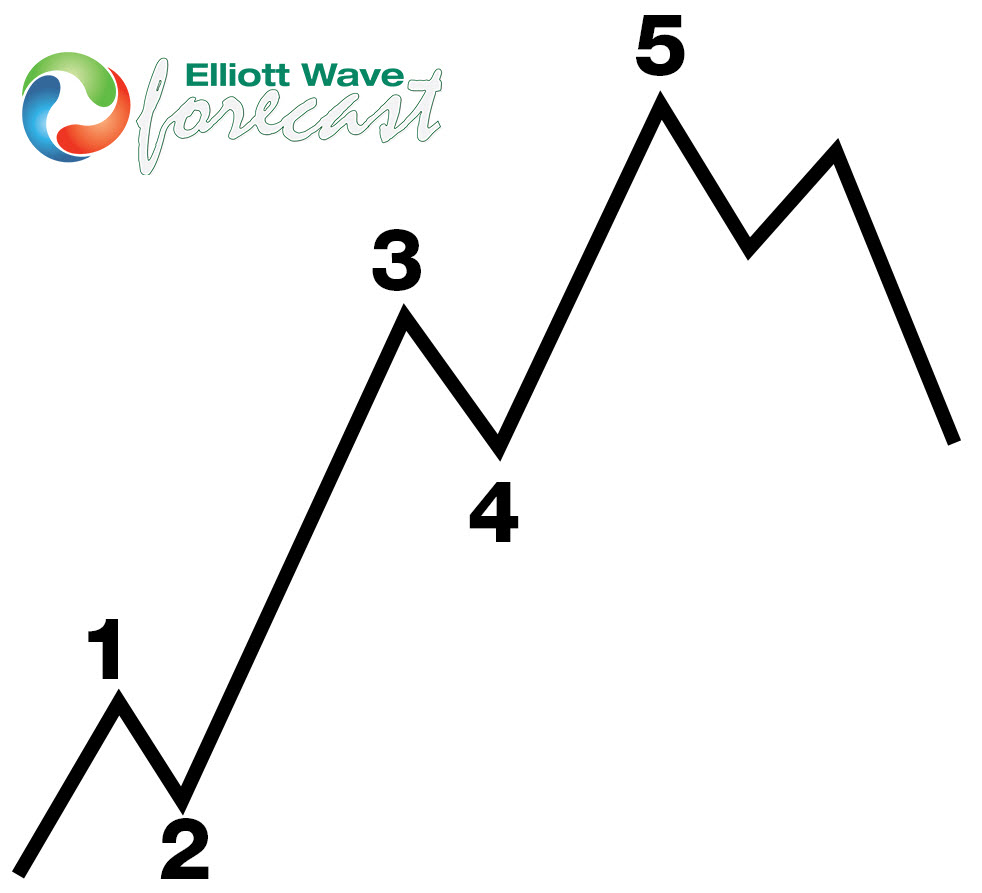

Besides technical characterists, Elliott wave analysts are also familiar with individual wave personality, which typically reflects the psychology of the moment. In the picture below you can see an example of the rising trend – 5 wave impulsive structure.

- Wave 1 is rarely obvious at its inception . Traders believe previous trend is still strongly in force and it’s usually considered as correction. Volume might increase a bit as move progressing, but not by enough to alert many technical analysts. Occasionally it could take structure of leading diagonal.

- Wave 2 corrects wave one and it could never extend beyond the start point of wave 1. In most cases it do not retrace more than 61.8 % or 76.4% of wave 1. It usually takes form of Zig Zag, Flat or Double Three and it could never be a Triangle. Volume should be lower during Wave 2 than during wave 1.

- Wave 3 is usually the largest and most powerful wave in a trend. Price is progressing quickly, corrections are short –lived and shallow. By wave 3 midpoint the crowd will often join the new trend. Wave 3 must exceed at leas 1.618 fib extension of wave 1 and could go up to 2.618 fib ext or more. Wave 3 cannot be the shortest one.

- Wave 4 is typically clearly corrective. Price could do sideways for an extended period and typically retraces less than 38.2 %, usually 23.6% of wave 3. Fourth waves are often frustrating because of their lack of progress in the larger trend. Wave 4 does not overlap with the price territory of wave 1, except in the case of a diagonal. It often takes structure of flat, triangle or irregular correction. At Elliottwave-Forecast.com, we don’t label a wave 4 if it passes 50% Fibonacci retracement of wave 3 (unless a diagonal)

- Wave 5 is the final leg in the direction of the dominant trend. The news is almost universally positive and everyone is bullish. Unfortunately, this is when many average investors finally buy in, right before the top. Volume is lower in wave five than in wave three, and many momentum indicators start to show divergences. It often takes form of ending diagonal structure.

If you want to learn more on how to implement Elliott Wave Theory in your trading, fell free to join us. You will get access to Professional Elliott Wave analysis in 4 different time frames, 2 live webinars by our expert analysts every day, 24 hour chat room support, market overview, daily and weekly technical videos and much more…

If you are not member yet or Elliott Wave Subscribers, just sign up here to get your Free 14 days Premium Plus Trial.

Welcome to Elliott Wave Forecast !