EWP The 5 waves Structure: Interview with Eric Morera @ElliottForecast

August 7, 2016

$EURAUD: Elliott Wave Flat structure

August 7, 2016$DAX : Elliott Wave Zig Zag Pattern

Zig-Zag is the most famous corrective pattern in Elliott Wave Theory, but in reality we don’t see it very often. These days we could see very nice zig zag pattern that forming in DAX h1 chart. Before we take a look at real example we will explain the Elliott Wave pattern first.

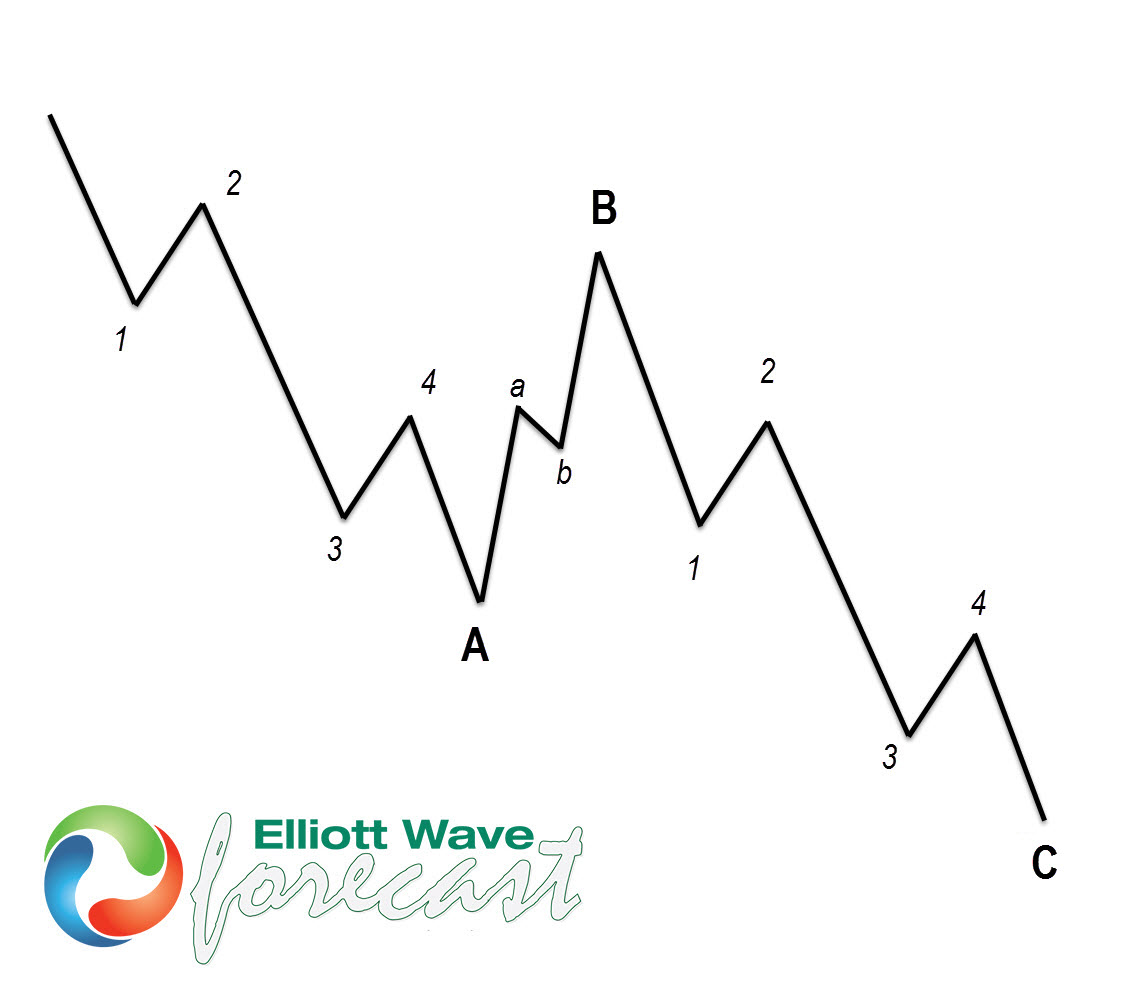

Zig zag iz 3 wave corrective Elliott Wave pattern that contains 5-3-5 inner structure. It’s labeled as A,B,C where A =5 waves, B=3 waves and C=5 waves. That means A and C are impulsive or diagonal patterns and they must meet all conditions of being 5 wave structures such as: having RSI divergency between wave subdivisions, ideal Fibonacci extensions, retracements and so on…

On the picture below we see what bearish Elliott Wave Zig Zag pattern looks like: clear 3 wave ABC form, with 5,3,5 inner structure…