September 29, 2016

Published by admin at September 29, 2016

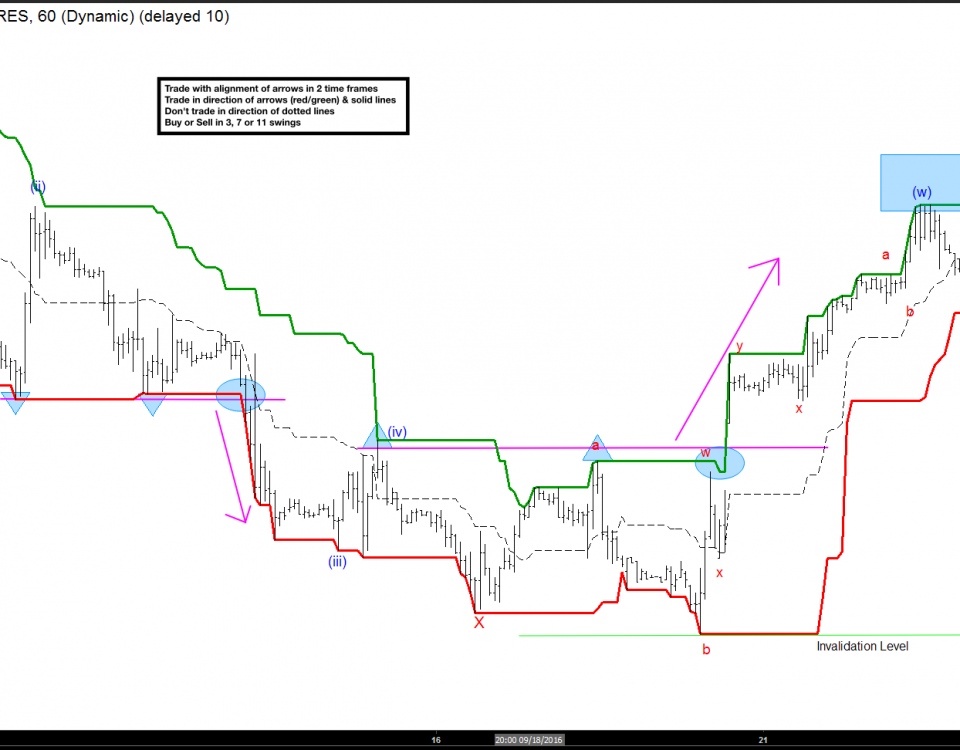

Determining when and where a range has occurred is one of the easiest price patterns to observe: choppy, sideways, and goes nowhere. Once a range bound market has been determined, via Elliottwave analysis or simply observing sideways price action, you can use the tools and methods highlighted in this video blog post to help determine potential breakout targets! The equal legs (100% extension) price measurement tool has many uses, and in this case, it can define a very logical and technical price target for a potential market move (once the market has committed to one direction or the other). CL […]

September 28, 2016

Published by admin at September 28, 2016

Categories

Breakout indicators and breakout trading plans are usually not well discussed in the trading community. They also happen to require specific markets that behave a specific way. A good market for a breakout trading plan is one that has a tendency to trend, without much regression, for sustained periods of time. The periods of time in question are relative to the scale at which you are viewing the market, but the trend needs to be very easily defined. Historically, commodity markets fit the profile for breakout strategies best. They often have long and sustained seasonal trends, which tend to have […]