September 12, 2016

Published by admin at September 12, 2016

Categories

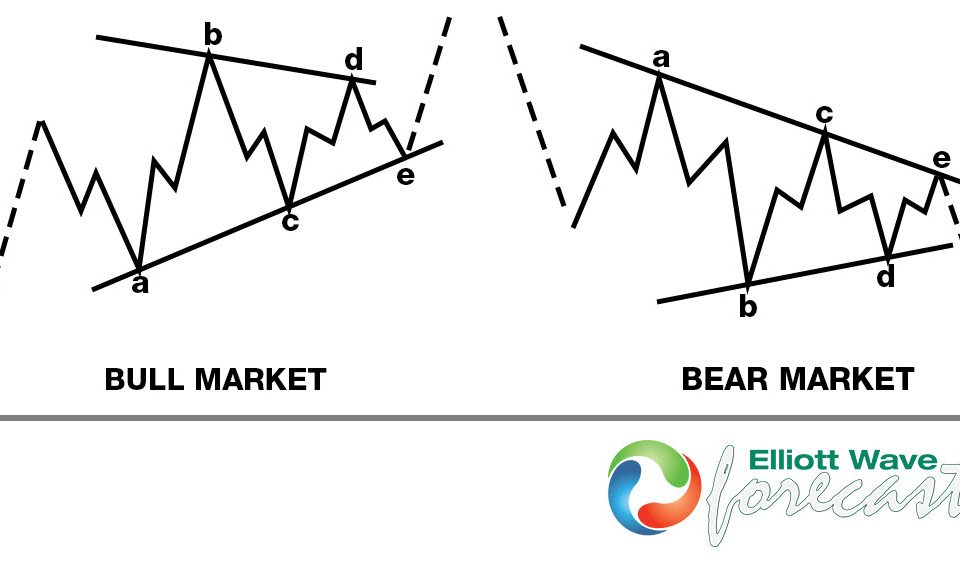

The triangle is an often elusive price structure that most traders do not notice until its too late! In this video, I take you through the first stages of a triangle or sideways market price action in order to better prepare you for the incoming chop. The better you are at identifying when a market is susceptible to sideways price action, the easier it will be to adapt your trading for it. Trend following strategies often get beaten up in such scenarios, so learning to identify choppy price action early will save you your hard earned pips in the long […]

September 12, 2016

Published by admin at September 12, 2016

Categories

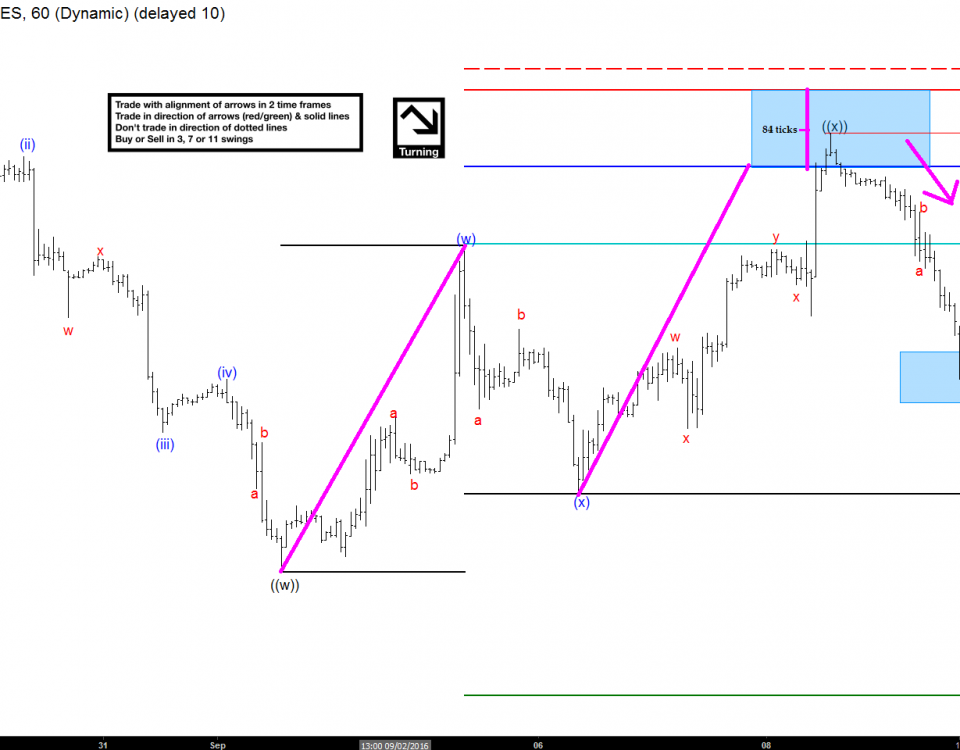

Price measurement is one of the easiest ways to identify trading possibilities. We can use it to identify trend, trend reversals, potential targets, stops, entries and much more. One of my favorite tools is the Fibonacci Extension Price Measurement. This tool is very similar to the Fibonacci Retracement tool in that it utilizes the golden ratio and the Fibonacci sequence to determine pattern in price measurement. This is however, where the similarities end. The Fibonacci Extension tool is used to measure a price projection (as shown in figure A) rather than a retracement (as shown in figure B). Figure […]

August 7, 2016

Published by admin at August 7, 2016

Categories

I was thinking today about how I really started taking this blog increasingly social jargon, investor’s education, competitions, contests values , and the like. And among all this remarkable, entertaining, educational, intellectual and I forgot to mention an important fact that every trader knows or should know information. The fact is that any rational analysis on the market will flow back to one of two ways: Either Fundamental or Technical view. Just read the letters and look at the volumes, trends and lines of support or resistance? Well, then you are very focused on technical analysis! Do you base your […]

August 7, 2016

Published by admin at August 7, 2016

Categories

Technical trade vs Fundamental trade A huge debate is which type of trading to follow, many Market participants always find themselves between the dilemmas of which way to follow. Like everything in life, a person needs to have a criteria in order to make a decision and being consistent in the criteria is what makes better decisions in the long run. Trading is a long run when nobody wins all the trades, as well as nobody loses all the trades. Elliott wave Principal is a technical way of trading and have nothing to do with the Fundamental trade. Traders usually try to […]

August 7, 2016

Published by admin at August 7, 2016

Categories

The psychology behind trading is the force that makes the moves in the market. Besides a good Elliott Wave analysis and proper money management, trading psychology is crucial for being successful in this business. There are four psychological kinds of emotions that drive most individual decision making in any market in the world: Greed, Fear, Hope and Regret. 1. Greed could be defined as a trader’s desire to trade in order to provide an unrealistic profit. Greedy traders focus only on how much money they could have made. This emotion frequently leads to ignoring proper money management and often prevents […]

August 7, 2016

Published by admin at August 7, 2016

Categories

The Market is the king of all kings when it comes to trading. Many traders enter the Market with the belief that they will become multi-millionaires in a very short period of time and start disrespecting the Market. As we have always said, the Market is very mysterious and most trader experience a higher degree of success during early stages. It is at this early stage when the Disease of me starts growing and creating a very turbulent and dangerous future for the traders. Ego by definition is in your conscious mind, the part of your identity that you consider your “self.” If you […]