Articles

August 7, 2016

Published by admin at August 7, 2016

Categories

In this video we will explain how we can identify 5 waves impulsive move, which is the most popular structure and everyone with some knowledge of Elliott Wave are familiar with. However, this 5 waves move do not happen that often in today’s market, compared to the market in the past. So what are some of the criteria used to label moves as 5 impulsive waves? Watch this video and learn how to identify impulsive waves using the 1 hour chart of Corn. Please note that the rule states wave 4 should not overlap with wave 1 but at EWF, […]

August 7, 2016

Published by admin at August 7, 2016

Categories

In this educational video, we will talk about the Elliottwave zigzag structure. Zigzag is a corrective 3 wave move labelled as an ABC. Zigzag is a 5-3-5 Elliott wave structure but zigzag can also be the internal structure of a double three WXY or an internal structure of a triple three WXYZ. What are some of the characteristics of zigzag and the relationship between the swing? For further reading and tips, feel free to read our technical articles at Technical Blogs, check Chart of The Day, or take 14 days FREE trial We offer 24 hour coverage of […]

August 7, 2016

Published by admin at August 7, 2016

Categories

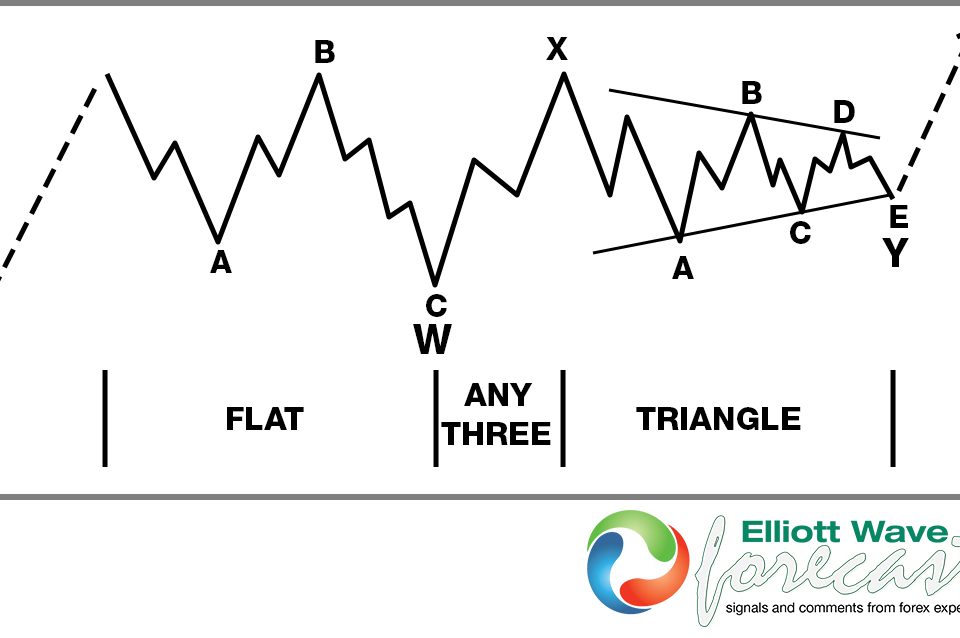

The patterns that usually occur in the market can be subdivided in two main categories: Impulsive pattern and corrective pattern. The main difference between these two groups is in Impulsive pattern the move in the market is sharp and without overlap but in corrective pattern, we see sideway and overlapping price actions. The impulsive patterns are labeled by numbers ( 1,2,3,4,5 or i,ii,iii,iv,v) and corrective patterns by letters (A,B,C or W,X,Y,Z). The objective of this blog is to show very briefly the more common patterns and how to use labels for them. The Impulsive Pattern: An impulsive pattern is a […]