Articles

August 7, 2016

Published by admin at August 7, 2016

Categories

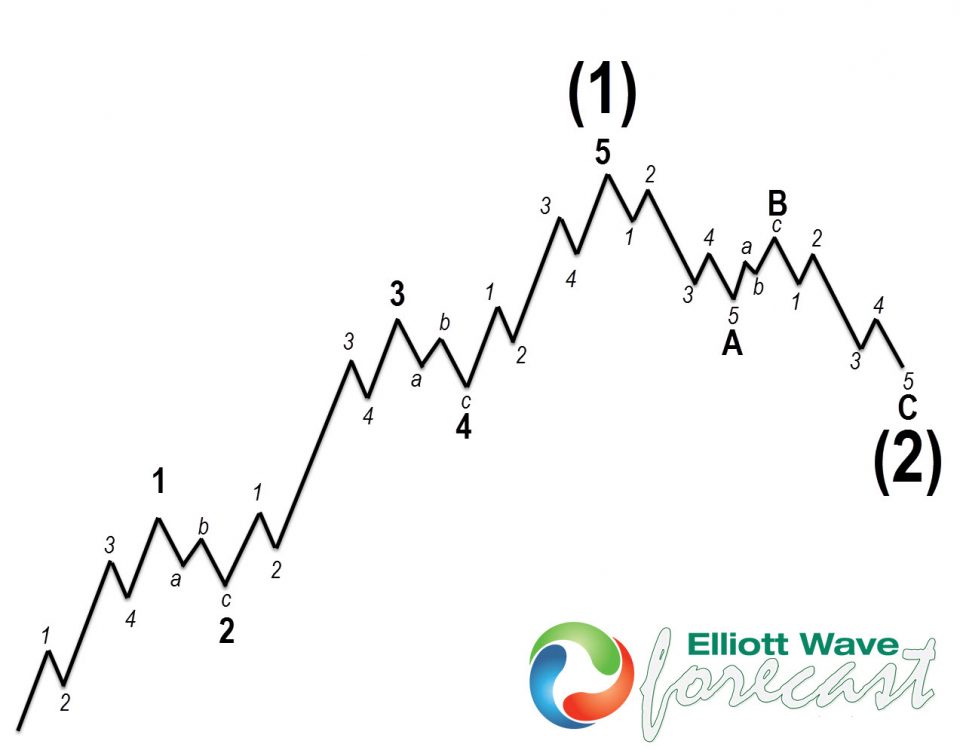

In this technical blog we’re going to learn how to identify the most popular among the Elliott Wave patterns: 5 wave Impulsive structure. We’ll get through all conditions which must be met for this popular structure. Many wavers believe that market is always trending in 5 waves, which certainly isn’t the case. Nowadays most markets (with the exception of stock markets) are usually trending and correcting in 3, 7 or 11 swings. The Impulsive structure is not as frequent as it used to be and it must meet all of the rules we’re going to mention. If you don’t follow […]

August 7, 2016

Published by admin at August 7, 2016

Categories

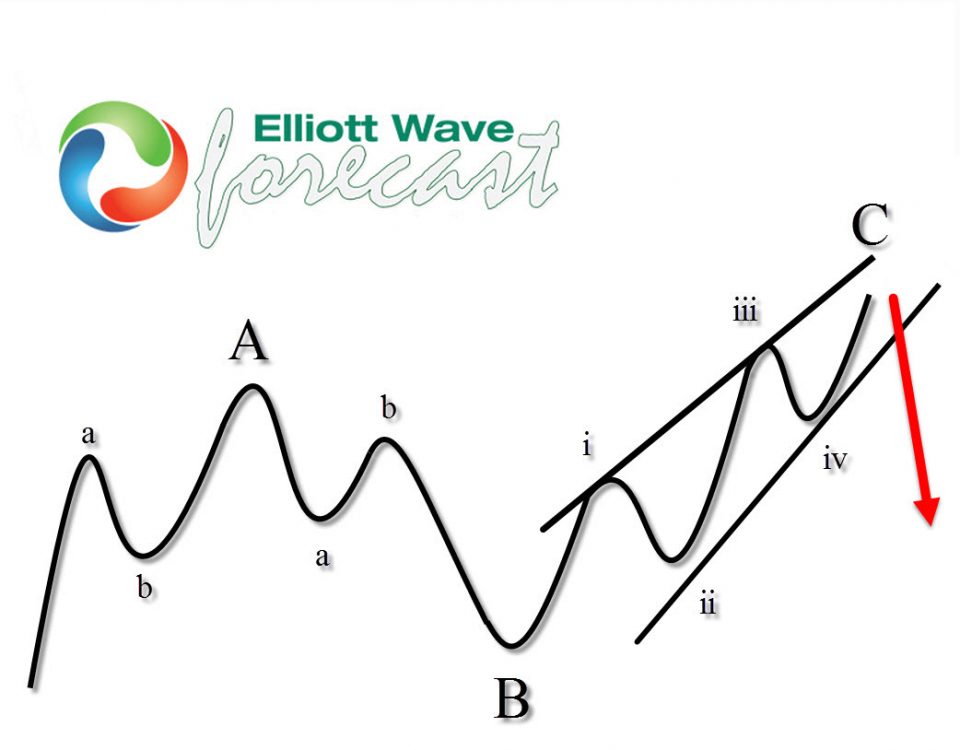

In this technical blog we’re going to explain what Elliott Wave Flat Pattern should look like. Flat pattern is corrective structure which could be often seen in the market nowadays.There are 3 types of Flats: Regular, Expanded and Running flat. In this technical blog we’re going to run through the Regular flat example. At the graphic below, we can see what Regular Flat structure looks like. Inner subdivision is always labeled as A,B,C and it has 3,3,5 structure. That means waves A and B are corrective structures, while wave C is 5 wave impulsive or ending diagonal pattern. Wave B […]

August 7, 2016

Published by admin at August 7, 2016

Categories

In this interview by Dale Pinkert at Nov 11, 2015 with our chief currency strategist and founder Eric Morera, we cover the rules and idea of 5 impulsive waves in Elliottwave Theory. Eric explained in this video that in today’s world, trend doesn’t only move in 5 waves, but trend also moves in 3 waves. It’s different than the world in 1930s where the original Elliottwave Theory was founded. This idea of 3 waves as a trend is especially true in the forex market where two central banks are competing with each other. Eric then went on to explain the rules for 5 impulsive […]